It’s that time of year again – tax season! It’s one of only two things guaranteed in life (the other is death, if you’re unfamilar with the saying ). If you made any money with your Turo business last year then Uncle Sam has his hand out waiting for his cut. Make sure you don’t give him a dime more than you owe!

Turo actually has a 25-page guide for reporting your earnings on your taxes, aptly titled “General Guidance on the Taxation of Business Income” (100% sure that was named by an accountant). I recommend you read the whole thing if you’re serious about your business. But I’ll try to provide some highlights here.

The usual disclaimer applies: I am NOT an accountant, tax advisor, CPA, tax attorney, financial advisor, or any other professional qualified to give tax advice. This is not even advice, so don’t take it as such. Talk to a professional, and better yet, have a professional do your taxes!

Ok, let’s dive in.

Tax form 1099-K

Turo will provide you with a form 1099-K showing your earnings and tax summary. According to the IRS, whether you own a business, are self-employed, work in the gig economy, or sell personal items, form 1099-K includes the gross amount of all payment transactions. For Turo, this includes unadjusted gross sales, or the total amounts received from each Turo booking before being reduced by cancellations or Turo fees, plus any other payments received from Turo.

This is not to be confused with your trip earnings shown on your host dashboard, as that number does not include turo fees, host incentives, or host cancellatioon fees. Confused? Talk to a professional!

Turo Business Deductions

The best part about running a business is all the tax deductions you’re legally allowed to take. Make sure you deduct EVERYTHING you’re entitled to. Here’s an incomplete list of deductions you can take for your Turo business (consult with a tax professional for even more):

1. Car maintenance (oil changes, tire rotations, safety inspections)

2. Car washes

3. Car repairs not covered by insurance

4. Gas

5. Turo fees

6. Insurance

7. Interest on car loans

8. Supplies used for maintaining your cars or operating your business (vacuums, disinfecting wipes/sprays, air fresheners, lock boxes, child seats, coolers)

9. Car parts

10. Car registration fees

Again, this is not a complete list of deductions. It’s just meant to get you started. Think of everything you spent money on in order to run your business. It’s probably deductible. Hopefully you kept really good records throughout the year.

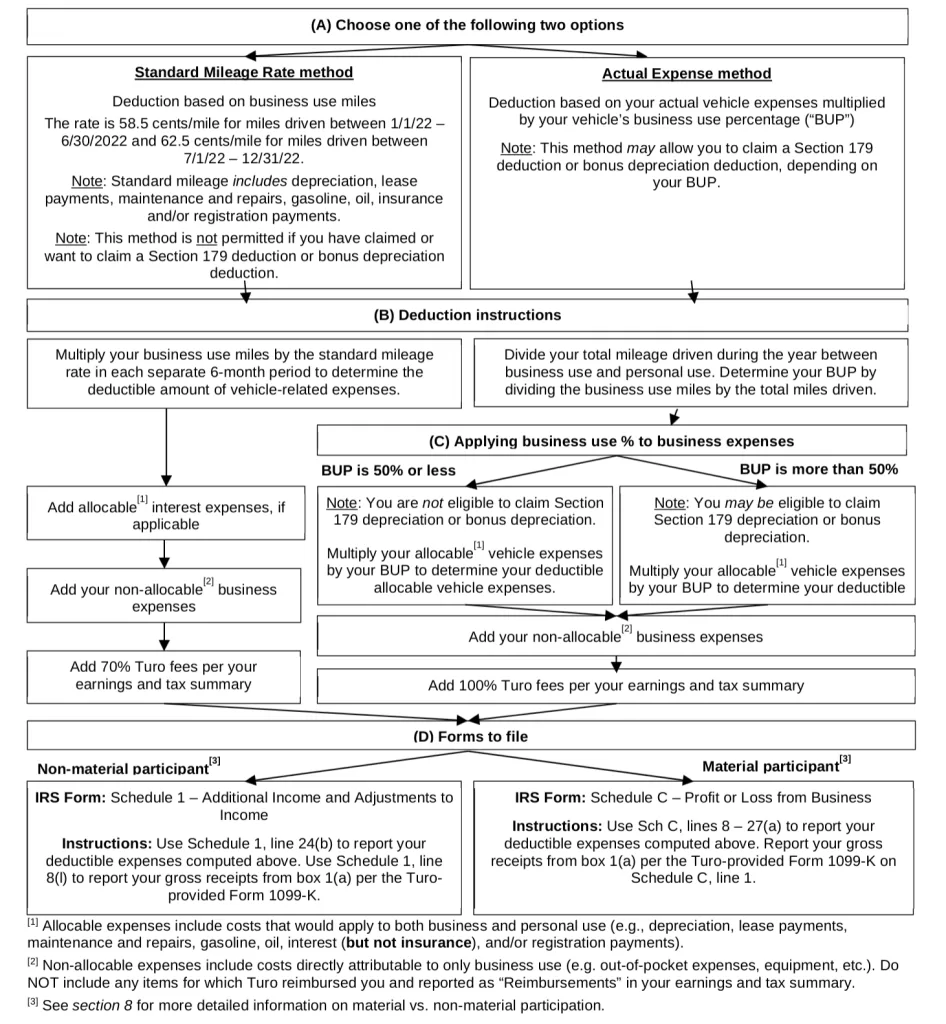

Choose your deduction method: Standard Mileage Rate vs Actual Expense

I couldn’t explain this one if I tried. Here’s a really good flowchart from the Turo guide.

Summary

Taxes are boring…and confusing. There are so many nuances and variables that it’s impossible to provide any kind of one-size-fits-all advice in a blog post. My best advice is to speak with a professional tax advisor and have them give you specific guidance for your particular situation.

Owning a business can provide a lot of opportunities for tax savings, but only if you know how to apply them (or hire someone who does). Don’t take this process lightly, and don’t pay more than you’re legally required to pay in taxes. I’m using a professional CPA again this year, and would advise most of you to do the same.

Good luck!